Ever wondered what happens to the families of our soldiers, paramilitary personnel, and police officers if tragedy strikes? It’s a grim thought, but thankfully, Punjab National Bank (PNB) has stepped up with the **Rakshak Plus Scheme**—a financial safety net designed specifically for our uniformed heroes and their loved ones.

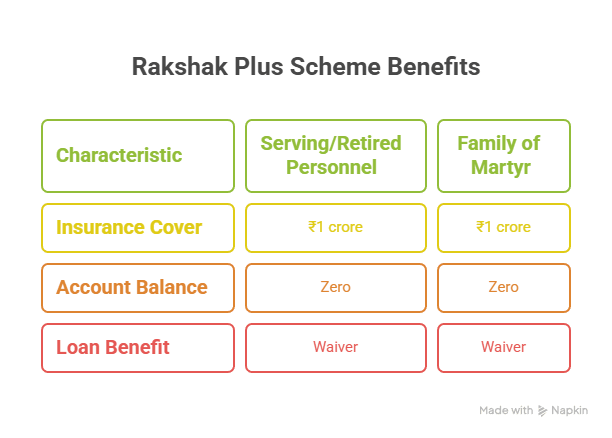

Whether you’re serving, retired, or a family member of a martyr, this scheme packs some serious benefits—from ₹1 crore insurance cover to zero-balance accounts and loan waivers. Intrigued? Let’s break it down in plain, no-nonsense terms.

Why the PNB Rakshak Plus Scheme Matters

Let’s be real—most of us take financial security for granted. But for defence and paramilitary personnel, the risks are sky-high. The PNB Rakshak Plus Scheme isn’t just another banking product; it’s a lifeline for those who put their lives on the line every day.

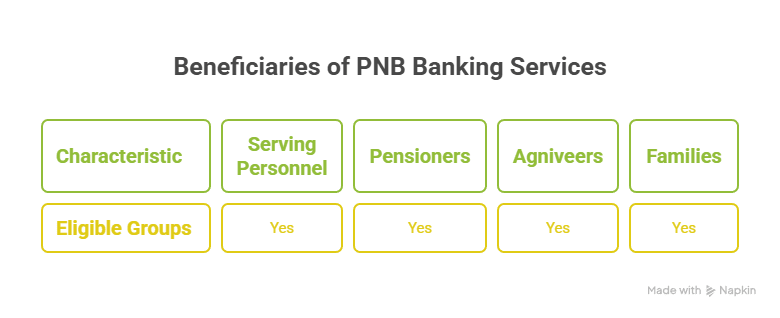

Who’s Eligible?

- Serving personnel (Army, Navy, Air Force, BSF, CRPF, CISF, ITBP, state police, etc.)

- Pensioners (if your pension is credited to a PNB account)

- Agniveers (under the Agnipath Scheme)

- Families (spouses, parents, dependent children)

If you fall into any of these categories, you’re in.

Key Benefits: More Than Just Insurance

1. Insurance Coverage That Actually Means Something

For Serving Personnel:

- Death in the line of duty? ₹1.1 crore (₹1 crore + ₹10 lakh extra for operational risks).

- Permanent disability? ₹1 crore.

- Air accident? ₹1.5 crore (because, let’s face it, chopper rides aren’t always smooth).

- Partial disability? Financial support to help you get back on your feet.

For Pensioners:

- Death due to accident? ₹50 lakh.

- Air accident? ₹1 crore (yes, even after retirement).

- Permanent disability? Up to ₹50 lakh.

- No age limit—coverage continues as long as your pension is with PNB.

2. Real Support for Families of Martyrs

As of June 2025, PNB has disbursed ₹17.02 crore to the families of 26 martyred soldiers. That’s not just money—it’s respect and solidarity when they need it most.

3. Banking Perks That Actually Help

- Zero-balance accounts for family members (no more nagging minimum balance charges).

- Overdraft facility up to 3 months’ salary (₹75,000 to ₹3,00,000).

- Free RuPay debit/credit card with ₹10 lakh accidental insurance.

- No loan processing fees on home, car, or personal loans.

- Unlimited free demand drafts (up to ₹50,000 each).

Seriously, when was the last time a bank actually made your life easier?

How to Get These Benefits? (Spoiler: It’s Easy)

For Serving Personnel:

- Walk into any PNB branch.

- Show your service ID.

- Open a Rakshak Plus salary account.

- Boom—you’re covered.

For Pensioners:

- Already have a PNB account? Convert it to Rakshak Plus.

- No account? Open one and submit pension proof.

- Enjoy the benefits—no hassle.

For Families of Martyrs:

PNB directly coordinates with families to ensure quick payouts. No red tape, no delays—just support when it’s needed most.

Final Verdict: Is It Worth It?

Short answer? Absolutely.

The PNB Rakshak Plus Scheme isn’t just about insurance—it’s about honoring sacrifices and ensuring financial stability for those who protect us. Whether you’re serving, retired, or a family member, this scheme delivers real value.

So, What’s Next?

If you’re eligible, don’t wait. Head to your nearest PNB branch or check out their official page for details.

Because when it comes to financial security for our heroes, there’s no room for “maybe later.”

🚀 Stay safe, stay secure, and let PNB handle the rest.